Many foreign investors and people who want to live in Dubai in the future find buying an apartment there to be a good idea. The Dubai market keeps getting attention from all over the world because it has world-class infrastructure, high rental yields, and a friendly investment climate.

This blog will talk about the legal requirements, the steps to take, the costs, the best neighborhoods, and useful tips for foreigners who want to buy an apartment in Dubai in 2025. Here we will tell actually that how to buy an apartment in dubai as foreigners.

Why Foreigners Buy Apartments in Dubai

Important investment points

- Foreigners who buy property in Dubai’s designated freehold areas can get full ownership rights.

- Compared to many other big cities around the world, the market has relatively high rental yields, which makes it a good place for buy-to-let investors.

- Dubai is a good place to invest because it has low taxes, and most residential units don’t have to pay property tax every year.

- Buying property can also help some foreigners get a longer-term residence visa in the UAE.

How about the trends in the market?

Even though Dubai’s real estate market has been flourishing, new reports point to rising supply and possible price adjustments. Fitch Ratings, for instance, predicted a 15% price decline in the second half of 2025 and 2026. Reuters

Nevertheless, you can still make a property purchase a reliable asset if you plan carefully, picking the right location, paying the right amount, and seeking expert advice.

Who Can Buy an Apartment in Dubai?

Eligibility for foreign buyers

- International investors—non-UAE residents—can buy property without needing UAE citizenship or a residence visa.

- The primary prerequisite is that the property must be located in a freehold zone that allows foreign ownership.

- There aren’t many restrictions, including the minimum age. For instance, according to some sources, all you need is a current passport and evidence of income (for certain financing).

Freehold vs Leasehold

- Freehold ownership: You have the complete authority to sell, lease, or leave the apartment and land (in the freehold zone) to anyone you choose.

- Leasehold: A long-term lease that lasts up to 99 years; upon expiration, ownership returns to the leased land. This option may be available to foreigners who are not in freehold zones. Explore more about Freehold vs. Leasehold Property in Dubai

Step-by-Step Process to Buy an Apartment

This is a helpful summary of what to anticipate when making a purchase as a foreign national.

Step 1: Specify your goal and budget

Choose if you’re purchasing for investment (rental income) or

- Individual use (residence)

- Vacation or second residence

- This influences your financing strategy, budget, and location.

Step 2: Research the market and choose an area

- Choose freehold areas (central, waterfront, family-friendly) that fit your goals.

- Think about future amenities, infrastructure, demand for rentals, and developer reputation.

Step 3: Financing and payment plan

- As a foreign buyer, you have two options: use your own money to pay for the purchase or get a mortgage from a UAE bank; some banks now provide financing to non-residents.

- Developers may provide payment plans (installments) for off-plan (pre-construction) purchases.

Step 4: Legal verification & contract

- Select a real estate agent who is licensed and registered with the Real Estate Regulatory Agency (RERA).

- Make sure the property is eligible for freehold ownership, is registered, and is not subject to developer liens.

- After signing the Reservation or MOU (Memorandum-of-Understanding), you must sign the formal Sales & Purchase Agreement (SPA or “Form F”) and provide a deposit, usually 10%.

Step 5: Ownership transfer

- Request a No Objection Certificate (NOC) from the developer attesting to the absence of any unpaid debts.

- Attend the transfer at the trustee office of the Dubai Land Department (DLD). Get your title deed after paying a transfer fee, which is usually around 4% of the property’s value.

- After it’s finished, the apartment is legally yours.

Step 6: What to do after purchase?

- Make sure property management and maintenance agreements are in place, register utilities, and get a tenancy registration if you’re renting.

- Examine your eligibility for UAE residency through real estate investment, if applicable (see next section).

Expenses and Extra Charges to Consider

Consider more than just the “price tag” when creating your budget. There are several additional expenses:

- About 4% of the purchase price is the transfer fee (DLD).

- Fees for agents or commissions (if applicable)

- Fees for registration and documentation

- Maintenance and service fees (particularly crucial for apartments)

- Interest and mortgage setup costs (if you’re financing)

- International fund transfers and currency exchange fees (if paying from abroad)

- Non-residents may incur additional fees for foreign payments.

You can prevent unforeseen expenses by budgeting for all of these costs in advance.

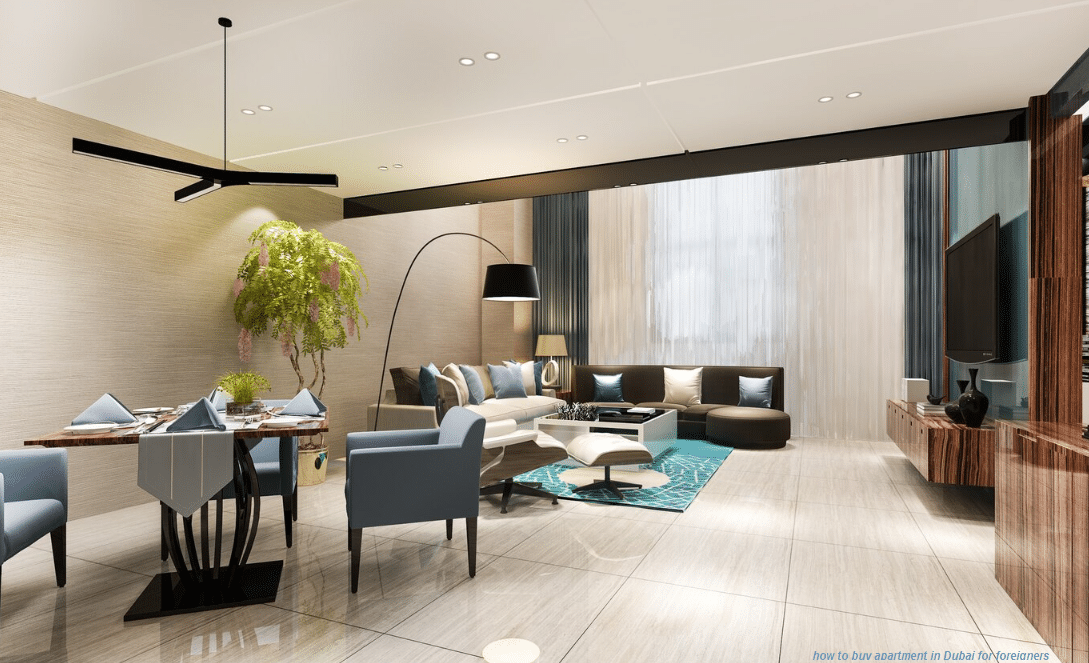

Best Areas for International Buyers in Dubai

These are some areas that foreign buyers prefer, though your ideal location will depend on your budget, lifestyle, and investment objectives:

Famous freehold zones

- Dubai Marina: high-rise apartments, waterfront, and high demand for rentals.

- Downtown Dubai offers luxurious high-rise living in a prime location.

- A little less expensive and a wise investment is Jumeirah Lake Towers (JLT).

- Dubai Hills Estate offers excellent community amenities and is family-friendly.

Your return on investment, level of lifestyle satisfaction, and resale value can all be greatly impacted by your choice of location.

Obtaining a Visa and Residency by Owning Property

Although it can make you more eligible for long-term visas, owning real estate in Dubai does not guarantee residency.

Golden Visa and investment criteria

You may be eligible for a 10-year Golden Visa if you purchase real estate valued at AED 2 million (~USD 545,000) or more.

In certain situations, purchasing real estate valued at AED 750,000 (~USD 204,000) may grant a two-year resident visa.

Because regulations can change, always confirm the most recent rulings with UAE authorities.

Risk Factors and Things to Avoid

Although there are plenty of opportunities in the market, wise buyers steer clear of typical pitfalls.

Watch out for these dangers:

- Making an investment in a non-freehold zone, where you might be subject to restrictions.

- Deciding on an off-plan project with a developer who doesn’t have a solid track record or licenses. Make sure to verify RERA registration at all times.

- Not factoring in maintenance and service expenses, particularly for big apartment complexes with shared amenities.

- Disregarding bank transfer fees or currency exchange risk when making payments from overseas.

- Ignoring post-purchase follow-up (such as maintenance, letting registration, and property management), which may result in fewer returns or legal problems.

It makes a significant difference to be aware of these and to have knowledgeable advisors (legal and real estate).

Why Choose Hundred Homes for Your Dubai Apartment Purchase

Our team at Hundred Homes specializes in advising international investors wishing to purchase apartments in Dubai. We offer:

- Professional advice on legal processes, freehold zones, and visa eligibility

- Exclusive listings of apartments (for investment or residential use) that are appropriate for foreign buyers

- Assistance with due diligence, ownership transfer, and documentation

- Effective service, especially for international buyers

Whether you’re buying for rental income, relocation, or future settlement, we can help simplify the process and reduce risk.

Frequently Asked Questions (FAQ)

Is it possible for a foreigner to purchase an apartment in Dubai without actually living there?

Indeed. Purchases in freehold zones can be made by non-residents without a UAE residency visa.

How much do I need for a down payment?

It varies. You pay full price if you buy it outright. Banks have different requirements when it comes to getting a mortgage. It may require a down payment of 20% to 30% or more for non-residents.

Do I have to pay any taxes?

At the moment, standard residential ownership in Dubai is exempt from annual property taxes. Nonetheless, you should account for other operating expenses and service fees.

What if I purchase off-plan?

Off-plan (pre-construction) offers frequently have flexible payment terms and a lower entry price. However, you must carefully review the developer’s qualifications, the project schedule, and the terms of the contract.

Final Thoughts

In 2025, buying an apartment in Dubai as a foreigner is a very attainable goal, but it requires careful preparation and professional assistance. Your choice today can set the stage for a valuable asset, a future home, or a profitable investment. This includes knowing the freehold zones and legal procedures, budgeting for extras, and picking the ideal location.

We at Hundred Homes are here to help you at every step, from finding the ideal apartment in Dubai to ensuring a seamless transaction and positioning you for long-term success.

Are you ready to start? Make an appointment for a consultation or visit us at hundredhomes.ae right now.